Frozen Dessert Market Size to be Worth USD 198.20 Billion by 2034, Driven by Health Trends, Innovation, and Regional Growth

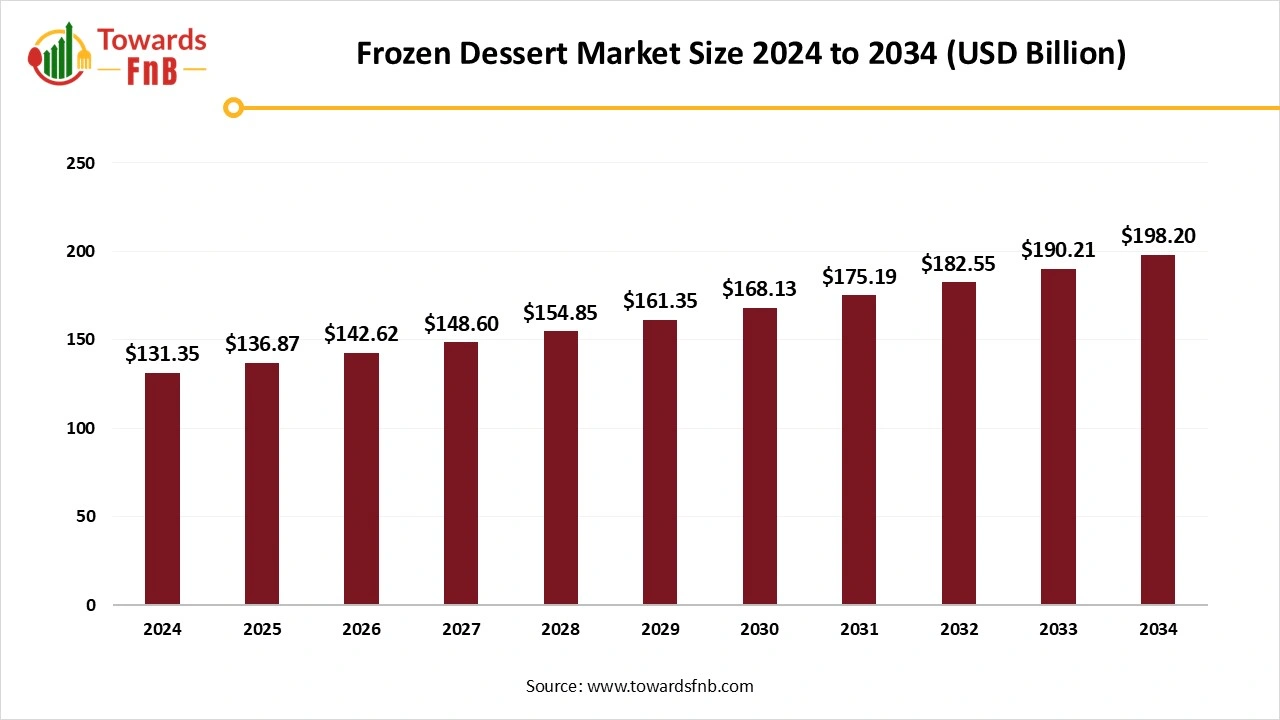

According to Towards FnB, the global frozen dessert market size is calculated at USD 136.87 billion in 2025 and is anticipated to surge USD 198.20 billion by 2034, reflecting at a CAGR of 4.2% from 2025 to 2034. The industry’s growth is primarily driven by technological advancements, shifts in consumer preferences toward healthier, low-sugar, and plant-based frozen treats, and innovations in production processes.

Ottawa, Oct. 31, 2025 (GLOBE NEWSWIRE) -- The global frozen dessert market size was valued at USD 131.35 billion in 2024 and is predicted to increase from USD 136.87 billion in 2025 to USD 198.20 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to high consumer demand for healthy, low-sugar, gluten-free, and tasty indulgences. Hence, the growing population of health-conscious consumers forms a major base for the market's growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5499

Key Highlights of Frozen Dessert Market

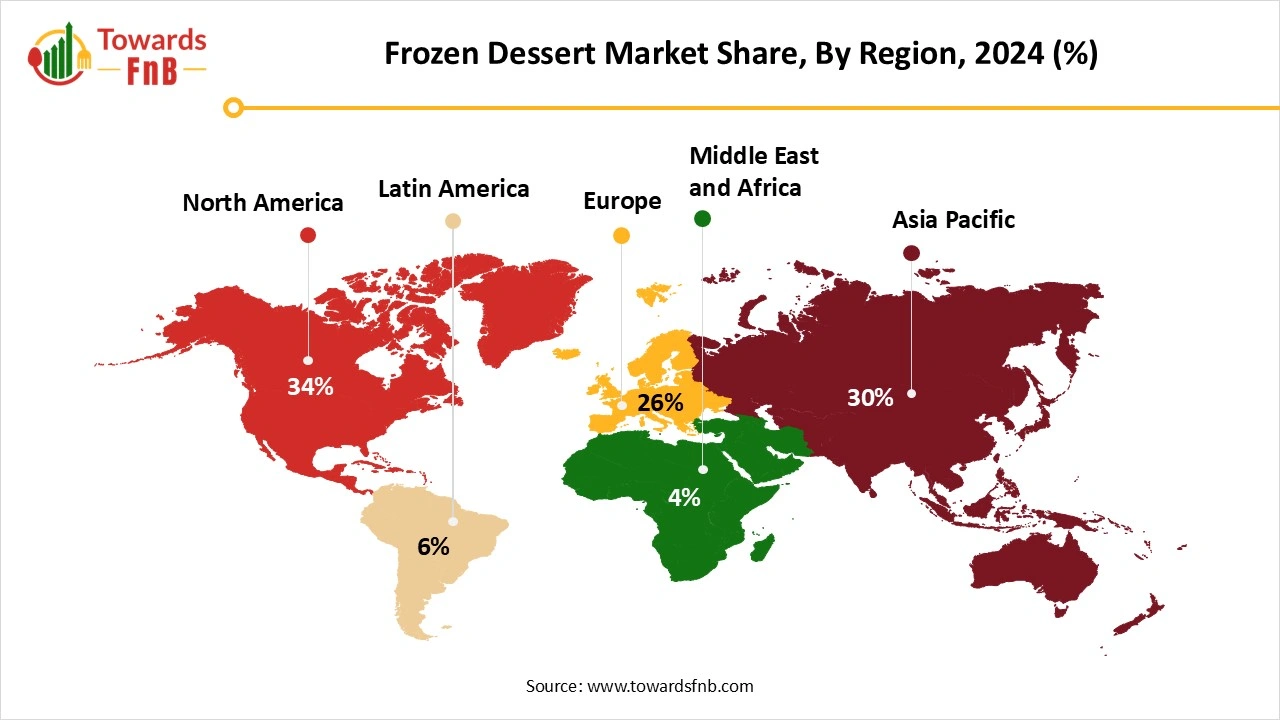

- By region, North America led the frozen dessert market with highest share of 34% in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product, the ice creams segment held the largest share in 2024, whereas the frozen yogurt segment is expected to expand with the highest CAGR in the foreseen period.

- By category, the conventional segment led the frozen dessert market in 2024, whereas the sugar-free segment is expected to grow in the expected timeframe.

- By distribution channel, the supermarkets and hypermarkets segment dominated the market in 2024, whereas the café and bakery shops segment is expected to expand in the forecast period.

Innovation in Freezing Techniques is Helping the Elevation of the Frozen Dessert Industry

The frozen dessert market is observed to be propelled majorly by factors such as high demand for sweet and healthy indulgences, rising disposable income, and increasing number of distribution channels. Frozen dessert is the process of freezing liquids, semi-liquids, and solids, then adding flavored water, liquids, colors, and custards. The market also observes growth due to high demand for international flavor profiles and artisanal desserts.

Innovation in freezing techniques, chilling, and freezing methods is also helpful to boost the market. The market is also influenced by innovation in packaging, cleaning, sanitation, and ingredient performance. Such methods help to preserve the flavors of frozen desserts and also manage their shelf life when kept in supermarkets or hypermarkets for consumers to shop for them.

Big Giants of the Frozen Dessert Industry

- Unilever PLC- Unilever PLC is a multinational consumer goods company that produces and sells a wide range of product categories. The brand has a huge frozen dessert portfolio consisting of brands such as Magnum, Cornetto, Ben and Jerry’s, and Kwality Wall’s. The portfolio also consists of new brand launches such as Breyers, Talenti, and Popsicle.

- Nestle- Nestle is another renowned brand for frozen desserts with a huge brand portfolio such as Drumstick, Häagen-Dazs, and Nestle Ice Cream. Products such as vanilla sandwiches, fudge bars, and dibs are also provided by the brand to cater to their consumer needs.

-

General Mills- General Mills offers a variety of frozen desserts by premium brands such as Häagen-Dazs, Pillsbury, Betty Crocker, and Nature Valley.

New Trends of the Frozen Dessert Market

- Rising demand for plant-based indulgences and treats by consumers following veganism and plant-based diets is one of the major factors for the growth of the frozen dessert market.

- Higher demand for frozen desserts with organic and clean-label ingredients for enhanced nutritional profile is another major factor for the frozen dessert industry demand.

- Innovation in flavor profile and higher demand for interesting and unique flavors of frozen desserts are other major factors for the market’s growth.

- Availability of different types of frozen desserts on different platforms, such as supermarkets, e-commerce platforms, and restaurants and cafes, is another major push towards the market’s growth.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/frozen-dessert-market

Impact of AI in the Frozen Dessert Market

Artificial intelligence (AI) is transforming the frozen dessert market by enhancing product innovation, improving manufacturing efficiency, and delivering personalized consumer experiences. In research and development, AI-powered algorithms analyze large datasets on flavor preferences, ingredient combinations, and dietary trends to create innovative frozen dessert formulations, such as low-sugar, dairy-free, or protein-enriched options. Machine learning models simulate ingredient interactions to help manufacturers perfect texture, creaminess, and stability while maintaining nutritional quality and clean-label standards.

In production, AI-driven predictive analytics optimize freezing, mixing, and packaging processes to maintain product consistency and minimize waste. Computer vision systems and smart sensors ensure quality control by detecting crystallization issues, texture irregularities, or packaging defects in real time, ensuring that products meet safety and sensory expectations. AI also supports sustainability initiatives by reducing energy consumption and optimizing ingredient sourcing to minimize environmental impact.

On the consumer side, AI enables personalized marketing and product recommendations through e-commerce platforms and retail analytics, suggesting frozen desserts based on dietary needs (such as vegan, keto, or lactose-free) and flavor preferences. Sentiment analysis of online reviews and social media data helps companies quickly adapt to changing trends, such as demand for plant-based or functional desserts.

Recent Developments in the Frozen Dessert Market

- In October 2025, Wells Enterprises, the largest ice cream manufacturer in the US, unveiled its latest launch- Nutella Ice Cream and Kinder Bueno Frozen Dessert. The dessert is set to be shipped to convenience distributors by December 1, 2025. (Source- https://www.foodbev.com)

- In June 2025, Breyers launched its new Campfire Collection S’mores. The collection involves s’mores tubs and pints of 48oz. The product portfolio is described as a base of toasted marshmallow and crunchy graham cracker with milk chocolate by the brand. (Source- https://www.eatthis.com)

Frozen Dessert Market Dynamics

What Are the Growth Drivers of the Frozen Dessert Market?

Rising disposable income, higher demand for healthy and nutritious frozen desserts, and advancements in chilling and refrigeration techniques are the major growth drivers of the market. Advanced refrigeration techniques such as HPP and blast refrigeration help to keep the frozen desserts safe and enhance their shelf life as well, without using any preservatives. Higher demand for premium, artisanal, and healthier frozen desserts also helps to elevate the growth of the market. Consumers also demand frozen desserts made from organic, low-sugar, and functional ingredients for healthy snacking.

Opportunity

How are Technological Advancements Fueling the Growth of the Market for Frozen Desserts?

Technological innovations such as blast freezing, High-Pressure Processing, and automation in different procedures have helped to elevate the standard of the frozen dessert market. Such technological innovations are essential to maintain the texture, quality, and shelf life of the product. The techniques also help to keep frozen desserts free from bacterial attack without the use of any preservatives, which is helpful to maintain the product quality. Robotics and automation have further simplified the manufacturing processes. They help to manage procedures such as mixing ingredients, adding flavors, and packaging, further helping the growth of the market.

Challenge

Why are High Costs and Supply Chain Issues Hampering the Market’s Growth?

Fluctuating costs of essential raw materials such as sugar and dairy hamper the growth of the frozen dessert market. Issues in the supply chain affecting the essential supplies, such as packaging material or other raw ingredients, also slow the market’s growth and product launches. Hence, such issues obstruct the growth of the market.

Product Survey of Frozen Dessert Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / Consumption Context | Leading Brands / Producers |

| Ice Creams | Core frozen dessert segment, made from dairy or non-dairy bases with flavoring and stabilizers. | Regular, low-fat, sugar-free, plant-based, premium artisanal | Retail impulse sales, QSR desserts, home consumption | Unilever (Magnum, Cornetto), Nestlé, Amul, Häagen-Dazs, Blue Bell, Dairy Farmers of America |

| Frozen Yogurt | Fermented dairy dessert with probiotics and tangy taste; marketed as a healthier alternative to ice cream. | Soft-serve, scoopable tubs, drinkable yogurt | Health-conscious consumers, foodservice outlets | Menchie’s, Yasso, Red Mango, Yogurtland |

| Gelato | Italian-style frozen dessert with denser texture and lower air content; often premium-positioned. | Artisanal, low-fat, fruit-based | Cafés, premium retail, specialty outlets | Grom, Talenti, Amorino, Gelato Fiasco |

| Sorbet & Sherbet | Fruit-based, dairy-free frozen desserts; high in flavor and lower in fat. | Lemon, mango, berry, citrus blends | Vegan and lactose-intolerant consumers | Ben & Jerry’s, Häagen-Dazs, Talenti, Jeni’s |

| Frozen Novelties | Individually portioned items for on-the-go snacking. | Bars, cones, sandwiches, popsicles | Quick-service restaurants, retail multipacks | Nestlé (Drumstick), Unilever (Magnum, Cornetto), Wells Enterprises (Blue Bunny) |

| Plant-Based / Vegan Frozen Desserts | Made from non-dairy milks (almond, oat, soy, coconut); cater to vegan and lactose-free demand. | Cups, pints, bars, soft-serve | Vegan, flexitarian, and health-conscious consumers | Oatly, So Delicious, NadaMoo!, Arctic Zero |

| Frozen Custard | Creamy dessert similar to ice cream but with higher egg yolk content for rich texture. | Vanilla, chocolate, specialty flavors | Premium ice cream shops, fast-food chains | Culver’s, Freddy’s Frozen Custard & Steakburgers |

| Frozen Pudding & Mousse | Ready-to-eat, sweet frozen desserts; used for indulgence and portion control. | Chocolate, caramel, vanilla, mixed flavors | Retail packs, institutional catering | Kraft Heinz (Jell-O), Yoplait, Private Labels |

| Ice Pops & Fruit Bars | Simple frozen fruit juice or puree-based desserts; targeted toward kids and healthy snacking. | 100% fruit, low-sugar, fortified | Summer snacks, retail, kids’ products | Popsicle, Outshine, Chloe’s, GoodPop |

| Frozen Cakes & Pies | Bakery-dessert hybrids stored frozen for shelf life. | Cheesecake, ice cream cake, mousse cake | Retail, foodservice, QSR | Baskin-Robbins, Sara Lee, Dairy Queen |

| Dairy-Free / Functional Frozen Desserts | Enriched with protein, probiotics, or vitamins for health-oriented segments. | Keto, low-calorie, high-protein variants | Fitness and functional food markets | Halo Top, Enlightened, Yasso, Rebel Ice Cream |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5499

Frozen Dessert Market Regional Analysis

North America Led the Frozen Dessert Market in 2024

Higher demand for premium and artisanal desserts is one of the major factors for the growth of the market in the region. Consumers of the region also demand nutritious frozen desserts packed with unique flavors, further fueling the market’s growth. Consumers also demand frozen desserts in gluten-free, no-sugar, low-sugar, and organic options. Industrial mergers, acquisitions, and collaborations further enhance the growth of the market by expanding the frozen dessert industry in the region. Canada has a major contribution to the growth of the market of the region due to consumers’ habit of snacking outside and trying new and unique flavors.

Asia Pacific is Expected to Expand in the Foreseeable Period

Higher demand for frozen desserts and the availability of multiple frozen dessert retail outlets are two of the major factors for the growth of the market in the foreseeable period. Technological advancements, rising disposable income, and higher demand for healthy frozen dessert options with a nutritional profile are other major factors for the growth of the market. China has a major influence on the growth of the market in the Asia Pacific, as consumers of the country demand healthy and nutritious frozen desserts that are made with organic, clean-label, and functional ingredients such as probiotics, prebiotics, and protein.

Frozen Dessert Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 4.2% |

| Market Size in 2025 | USD 136.87 Billion |

| Market Size in 2026 | USD 142.65 Billion |

| Market Size by 2034 | USD 198.20 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Frozen Dessert Market Segmental Analysis

Product Analysis

The ice cream segment led the frozen dessert market in 2024 due to high demand by health-conscious consumers for nutritional and healthy ice creams. They are made by using organic, clean-label, and functional ingredients to enhance the nutritional profile of the product. Countries such as Germany, the US, and France have a major role in the development of the frozen dessert market due to high demand for artisanal and premium ice creams by consumers made from clean ingredients. Such treats allow consumers to enjoy without any guilt. Hence, the segment has a major role in the growth of the market.

The frozen yogurt segment is expected to grow with the highest CAGR in the foreseen period due to burgeoning demand for health and wellness food options. Frozen yogurt, low in fat and available in different flavor profiles, helps the growth of the market. Higher demand for products that are made from clean-label, organic, and functional ingredients further fuels frozen dessert market growth. Hence, frozen yoghurts are also used as a healthy snacking option or even meal replacements by consumers with hectic lifestyles. Hence, the segment has a major role in the growth of the market in the foreseeable period.

Category Analysis

The conventional segment led the frozen dessert market in 2024, as the segment consists of traditional frozen treats such as frozen yoghurt, ice creams, sorbets, and different types of frozen desserts. Such products are easily available on different platforms and are known to consumers as well. Hence, the segment plays an important role in the growth of the market. The segment also involves products that are easily feasible and available in price-friendly options. Hence, price-conscious consumers are highly inclined towards the segment, which is helpful for the growth of the market.

The sugar-free segment is expected to grow in the foreseeable period due to the growing demand for healthier options by health-conscious consumers. Consumers with issues like diabetes or consumers on a low-fat product search prefer healthier alternatives. Hence, sugar-free products are highly demanded by such consumers, fueling the growth of the market. Such products are made from natural sweeteners such as stevia and erythritol to avoid the use of refined sugar, which is helpful for the growth of the frozen dessert market.

Distribution Channel Analysis

The hypermarkets and supermarkets segment led the frozen dessert market in 2024 due to the easy availability of such stores in the localities of consumers. Such stores have a category of products aligned accordingly for the ease of consumers. Hence, consumers can easily shop for their favorite products along with their detailed information. Consumers can also browse through new product options, further fueling the growth of the market. Hence, the segment has a major role in the growth of the market.

The café and bakery shops segment is expected to grow in the foreseeable period due to the huge population visiting such places. Gen Z and millennials prefer to shop from bakeries and cafes to get quality frozen desserts. Such places also provide frozen desserts in nutritious and flavorful options, further fueling the growth of the market. Aesthetic appeal, socializing, and availability of different types of healthier and trendy alternatives at cafes are also some of the supportive factors helpful for the frozen dessert market growth.

Trade Analysis: Global Frozen Dessert Market

Top Exporters in the Frozen Dessert Market

- United States: The U.S. is one of the largest exporters of frozen desserts, including ice cream, frozen yogurt, and dairy-based novelties. Major brands such as Unilever, General Mills, and Blue Bell export to Latin America, Asia-Pacific, and the Middle East. The U.S. benefits from strong dairy supply chains, advanced cold-storage infrastructure, and high global demand for American-style flavors and premium indulgence products.

- European Union (France, Italy, Germany, the Netherlands, Belgium): Europe is a global hub for frozen dessert exports, especially premium gelato, sorbet, and dairy-based products. Italy leads in gelato exports, while France and Belgium export high-end frozen pastries and specialty ice creams. The Netherlands and Germany function as major re-export and logistics centers for frozen products shipped across Europe, the Middle East, and Africa. European exporters are distinguished by their focus on artisanal production, clean-label ingredients, and compliance with strict food safety standards.

- China: China has rapidly become a key exporter of mass-market frozen desserts, particularly frozen novelties and private-label ice cream brands. With its large-scale production capacity and cost advantages, China supplies neighboring Asian markets and increasingly exports to Africa and the Middle East. Domestic giants are also expanding into plant-based frozen desserts and sugar-free product lines to meet global demand.

- Thailand and Indonesia: These Southeast Asian producers export fruit-based frozen desserts, tropical-flavored ice creams, and frozen confectioneries to Asia-Pacific, the Middle East, and Europe. Thailand, in particular, has developed strong private-label partnerships with global retail chains for tropical and dairy-blend frozen desserts.

- New Zealand and Australia: Both countries export premium dairy-based frozen desserts, leveraging their reputation for high-quality milk and cream. Their exports are concentrated in Asia-Pacific, especially to China, Japan, and South Korea.

- India: India’s frozen dessert exports are expanding quickly, with growing shipments of ice cream, kulfi, and frozen dairy mixes to the Middle East and South Asia. Cost-competitive pricing and rising global recognition of Indian flavors (e.g., mango, saffron, and cardamom) have supported export growth.

Top Importers and Demand Centers

- Asia-Pacific (China, Japan, South Korea, India, Vietnam): APAC is the fastest-growing importer of frozen desserts, fueled by rising disposable incomes, Western food culture adoption, and an expanding retail cold chain. China is both a major producer and importer of premium international ice cream brands, while Japan and South Korea import European gelato and American ice cream varieties.

- European Union: The EU maintains high intra-regional trade, with countries like Germany, the UK, France, and the Netherlands importing from Italy and Belgium. Imports of plant-based and functional frozen desserts are also increasing due to consumer interest in healthier indulgence.

- North America: The U.S. and Canada import limited volumes of frozen desserts, primarily specialty and premium products such as Italian gelato, French sorbet, and Asian mochi ice cream. Demand for authentic, global dessert experiences supports this niche import segment.

- Middle East: The UAE and Saudi Arabia are key importers of frozen desserts, driven by rising tourism, a young consumer base, and the expansion of premium foodservice outlets. The UAE also serves as a re-export hub, distributing frozen products to other GCC markets.

-

Latin America: Countries like Brazil, Chile, and Mexico import both branded and private-label frozen desserts, particularly from the U.S. and Europe, to meet the growing demand for Western dessert formats.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Frozen Dessert Market

- Unilever PLC: Unilever is the global leader in the frozen desserts market, with flagship brands such as Magnum, Cornetto, Ben & Jerry’s, and Breyers. The company focuses on premiumization, sustainable sourcing, and plant-based ice creams, leveraging its extensive R&D to meet evolving consumer demands for healthier indulgence. Its strong global distribution network and product innovation keep Unilever at the forefront of both retail and foodservice frozen dessert segments.

- Nestlé S.A.: Nestlé is a major player in frozen desserts through brands like Häagen-Dazs, Mövenpick, and Drumstick. Known for its innovation in dairy-based and low-fat ice creams, Nestlé emphasizes quality ingredients, texture enhancement, and global flavor adaptation. Its investments in plant-based and lactose-free desserts strengthen its position in the premium frozen dessert segment.

- Froneri International Limited: Froneri, a joint venture between Nestlé and PAI Partners, is one of the largest global ice cream manufacturers, owning brands like Oreo Ice Cream, Nuii, and Häagen-Dazs (in select markets). The company excels in co-branded ice creams and private label manufacturing, combining operational efficiency with innovative flavor development for international markets.

- Dairy Farmers of America Inc. (DFA): DFA is a leading U.S. dairy cooperative producing ice creams, frozen yogurts, and dairy-based desserts under various regional brands. Its vertical integration—from milk production to distribution—ensures quality control and cost efficiency across its frozen dessert portfolio.

- Danone S.A.: Danone focuses on frozen yogurt and dairy-alternative desserts, aligning with the global shift toward healthy indulgence and probiotic-based treats. Through its brands like Oikos and Silk, Danone continues to expand its plant-based and low-sugar frozen dessert offerings.

- HP Hood LLC: HP Hood is a prominent U.S. dairy company offering a range of ice creams and frozen novelties under brands like Hood and Lactaid. The company emphasizes lactose-free and better-for-you dessert options, catering to health-conscious consumers.

- Walmart Inc.: Walmart plays a key role as a private-label frozen dessert producer, offering a wide range of affordable ice creams and frozen treats under its Great Value brand. Its focus on accessibility and product variety makes it a dominant player in the value segment of the market.

- Kellanova (formerly Kellogg Company): Kellanova extends its expertise into frozen dessert offerings through Eggo frozen waffles and breakfast-inspired desserts. The company is innovating by combining indulgence with convenience, particularly in North American households.

- China Mengniu Dairy Company Limited: Mengniu Dairy is one of China’s largest dairy manufacturers with a growing presence in frozen desserts and ice creams. The company’s focus on innovative flavors and healthy dairy formulations supports its rapid expansion in Asia-Pacific’s frozen dessert market.

- Arla Foods amba: Arla Foods produces a variety of dairy-based frozen desserts and ice creams, emphasizing natural ingredients, European craftsmanship, and sustainable dairy sourcing. Its operations span across Europe, Asia, and the Middle East.

- Blue Bell Creameries: Blue Bell Creameries is a U.S. regional favorite known for its rich, homestyle ice creams. The brand maintains strong customer loyalty through traditional flavors and limited seasonal releases.

- Dairy Queen (International Dairy Queen, Inc.): Dairy Queen operates as a QSR leader in frozen desserts, offering soft-serve ice cream, sundaes, and blended treats like Blizzards®. Its global presence and franchise model make it one of the most recognizable frozen dessert brands.

- London Dairy: London Dairy, owned by IFFCO Group, caters to the premium ice cream segment in the Middle East and Asia. The brand focuses on European-style ice creams, emphasizing rich textures and international flavors.

- Amul: Amul, India’s largest dairy brand, offers an extensive range of frozen desserts and ice creams at competitive prices. Its strength lies in mass-market appeal, wide distribution, and affordability, making it a major player in emerging markets.

- HANDEL’S Homemade Ice Cream: HANDEL’S is a premium artisanal ice cream brand known for its handcrafted, small-batch production and wide variety of flavors. Its local-first approach and fresh ingredient sourcing define its strong regional reputation.

- Bassetts Ice Cream: Bassetts is one of America’s oldest ice cream makers, renowned for traditional recipes and high-butterfat content ice creams. Its emphasis on quality and legacy craftsmanship appeals to nostalgic and premium consumers.

Segments Covered in the Report

By Product

- Confectionaries & Candies

- Ice Cream

- Frozen Yogurts

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- Café & Bakery Shops

- Online

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5499

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.